Weekly Crypto Market Wrap May 26–June 1, 2025

Last week was relatively calm on the surface — Bitcoin ended its 7-week green streak but still held firm above $105,000. Neither Trump’s political theatrics nor macroeconomic turbulence seemed to faze the market. Even the S&P 500 closed above 5,900, showing general resilience across asset classes. But beneath the calm, there was plenty of action. Here's what went down:

Trump Media Buys $2.5B in Bitcoin. If there were any lingering doubts about Trump being pro-crypto, they’re gone now. Trump Media & Technology Group officially announced it had acquired $2.5 billion worth of BTC for its treasury. This isn’t just talk anymore — this is maximalist-level conviction.

SEC: “Staking Is Not a Security”. In a surprising and welcome shift, the U.S. SEC ruled that crypto staking does not fall under securities regulation. A huge win for DeFi platforms, and a sign that common sense may finally be gaining ground in crypto regulation.

Senator Lummis Proposes 1M BTC U.S. Reserve. Yes, you read that right — Senator Cynthia Lummis plans to reintroduce a bill that would create a 1 million BTC national reserve. It’s a bold attempt to secure Bitcoin’s place as "digital gold" within the U.S. economy. Now all she needs is Congress to say yes.

Source: https://x.com/DeItaone/status/1927418255427195194

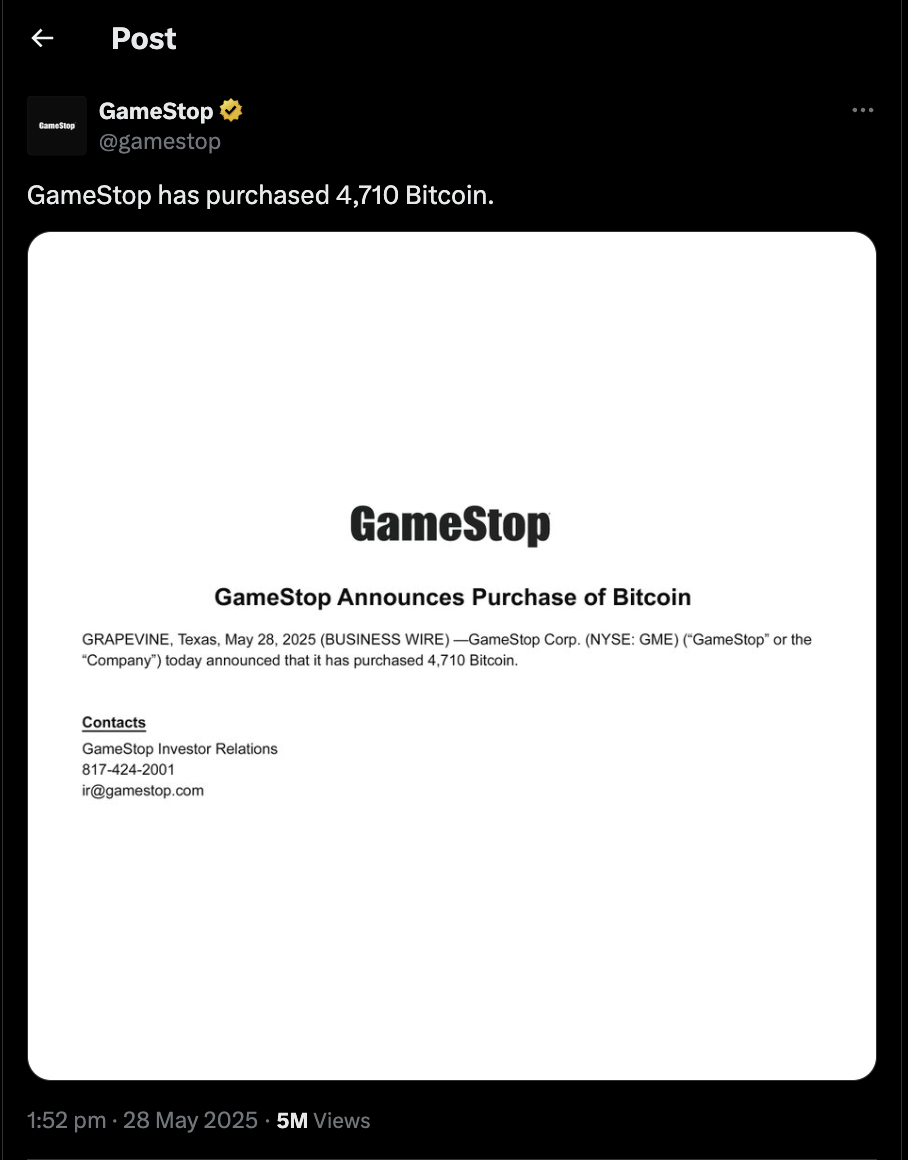

GameStop Buys 4,710 BTC ($512M). The original meme stock legend GameStop is now going full crypto. The company invested $512 million into Bitcoin — signaling it may one day sell games for sats. The pivot from retail to reserve asset is real.

Source: https://x.com/gamestop/status/1927679297252364502

SEC & Binance Settle Dispute. The nearly year-long legal drama between the SEC and Binance has come to a close. Both sides reached a settlement, clearing the path for Binance to move forward — and sending a positive signal to the entire market.

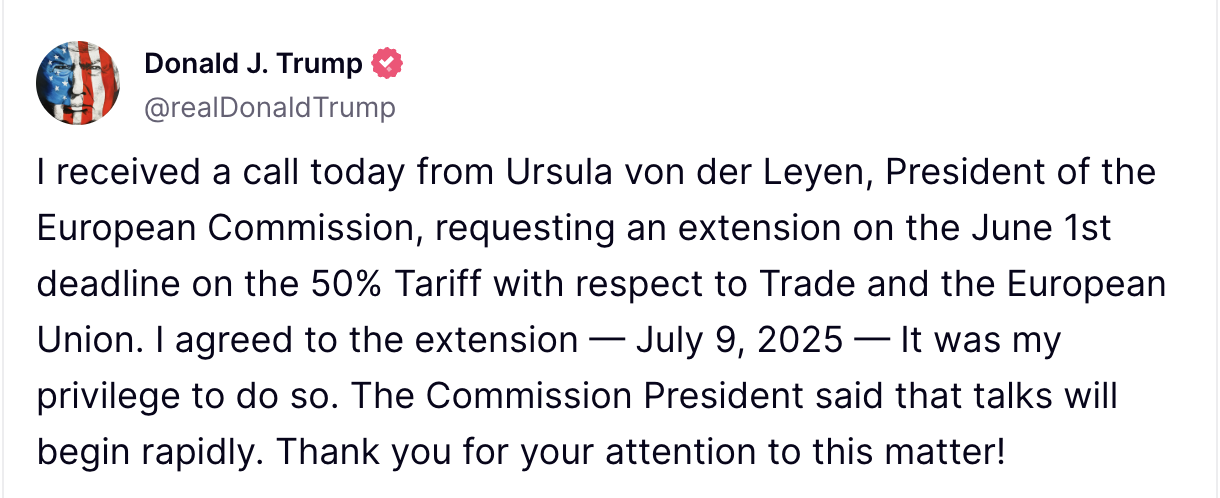

Trump Delays Tariffs on EU Imports. The threatened 50% tariffs on European imports have been postponed until July 9. That gives global markets a little breathing room — though the uncertainty still looms.

Source: https://truthsocial.com/@realDonaldTrump/posts/114570775887793036

OPEC+ Boosts Oil Production by 411K Barrels/Day. OPEC+ agreed to increase oil output, a move that may ease global inflation pressures — but also undercut prices. More oil, less pain at the pump… and possibly less pressure on the Fed.

Trump Accuses China of Trade Deal Breach. Trump accused China of violating trade terms, reigniting fears of another trade war. Markets don’t usually react well to that kind of saber-rattling.

Source: https://x.com/KobeissiLetter/status/1928424199611191363

Circle Files for IPO on NYSE. Circle, issuer of USDC, filed for a public listing on the New York Stock Exchange. A milestone moment that could legitimize stablecoins in the eyes of traditional finance.

Musk Denies Telegram–xAI Deal. Elon Musk denied any partnership between xAI and Telegram, triggering a quick dip in TON. Meanwhile, Pavel Durov insists the deal is still on — just pending signatures. Toncoin holders are buckled in for a volatile ride.

Source: https://x.com/elonmusk/status/1927839555828220165

Court Blocks Trump Tariffs, White House Appeals. A federal court struck down Trump’s latest tariffs, calling them unlawful. The White House responded by filing an appeal. Until the dust settles, the tariffs remain in place — more legal volatility ahead.

Source: https://x.com/DeItaone/status/1928166649636495472

U.S. Department of Labor Greenlights Crypto in Retirement Plans. In a major shift, the U.S. Department of Labor lifted its 2022 restrictions, once again allowing crypto allocations in 401(k) and retirement portfolios. A big win for long-term institutional adoption.

Upcoming major token unlocks:

ENA: $65.43M (3.7%)

TAIKO: $46.36M (70.2%)

NEON: $6.27M (22.4%)

SPEC: $3.61M (17.7%)

SXT: $2.46M

EIGEN: $1.74M (0.4%)

SimpleSwap reminds you that this article is provided for informational purposes only and does not provide investment advice. All purchases and cryptocurrency investments are your own responsibility.