Weekly Crypto Market Wrap May 19-25, 2025

Bitcoin hit a new all-time high of $111,814, but despite the milestone, it ended the week with just a +0.73% gain. The reason? Trump is back — and not with peace, but with threats of 50% tariffs on EU imports. However, after speaking with Ursula von der Leyen, he reversed course and postponed the decision, flipping the political script once again.

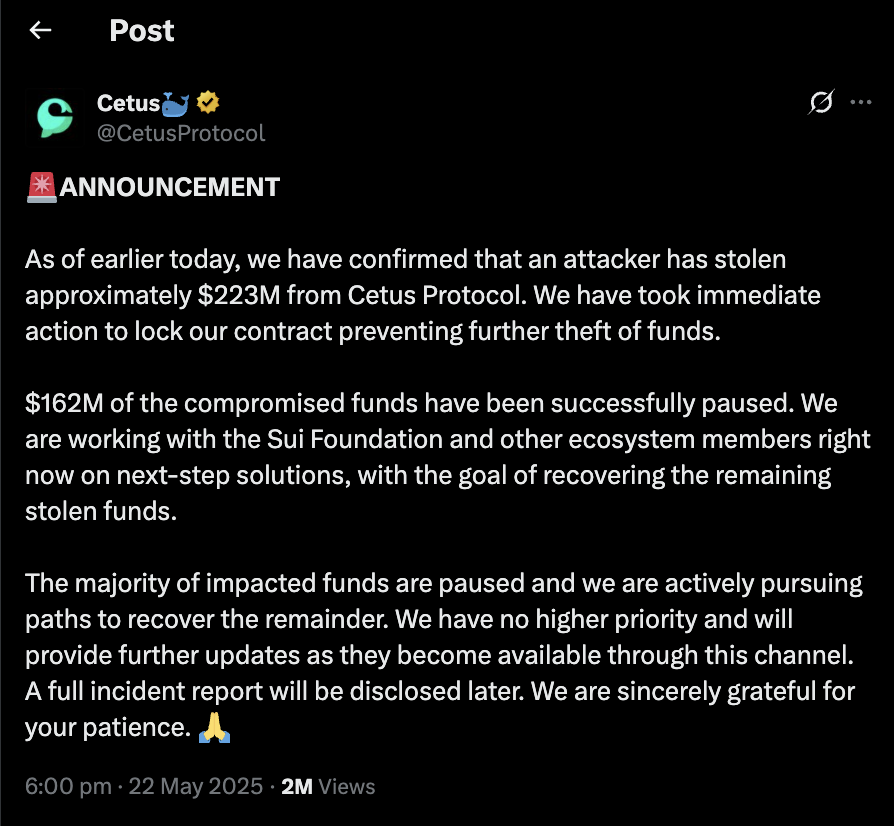

Altcoins reacted unevenly. While majors saw moderate gains, the Sui ecosystem got hit hard after a $223M exploit on the Cetus DEX, sending many tokens tumbling up to -80%. Fortunately, the team has recovered $162 million, making for an almost happy ending.

Now on to the rest of the week's news:

Texas Approves State Bitcoin Reserve. The Texas House of Representatives has passed legislation to create a state-run Bitcoin reserve, officially backing BTC as a “rainy day” asset. The Lone Star State is going full cowboy — with cold wallets.

BlackRock’s Bitcoin ETF: Record-Breaking Inflows. BlackRock’s IBIT ETF ranked among the top 5 ETFs by net inflows in 2025, pulling in over $9 billion — outperforming 99% of traditional funds. Bitcoin is becoming mainstream, not through hype, but through passive institutional inflows.

Source: https://x.com/EricBalchunas/status/1925152281558737026

Saylor Stays Bullish: +7,390 BTC This Week. MicroStrategy added another 7,390 BTC worth $765 million, bringing its total holdings to 576,230 BTC. But wait — there’s more: the company plans to raise $2.1B via stock offerings to buy even more. Michael, when and where will we ever sell?

Polygon Co-Founder Mihailo Bjelic Exits. Mihailo Bjelic, one of the co-founders of Polygon, has stepped down from Polygon Labs and its board. Whether this is just corporate rotation or the end of an era for one of Ethereum’s top L2s, only time will tell.

Kraken Tokenizes Apple, Tesla, and Nvidia. Kraken has introduced tokenized stocks on Solana, allowing users to trade shares of Apple, Tesla, and Nvidia directly on-chain — no broker needed. Wall Street and DeFi are starting to blur into one.

Moody’s Downgrades U.S. Credit Rating. Moody’s has downgraded the U.S. from AAA to AA1, citing rising deficits, political instability, and ongoing debt ceiling drama. For crypto, this is usually good news — the worse it gets for fiat, the better it is for Bitcoin.

Trump Targets EU & Apple with Tariffs. Trump first announced 50% tariffs on all EU imports starting June 1, and then threatened Apple with a 25% import duty if it keeps manufacturing outside the U.S. Politics is starting to look like an NFT — new mood every day.

Argentine President Disbands LIBRA Investigation. Argentina’s President Javier Milei has shut down the investigative body probing the LIBRA meme coin scandal, allegedly linked to his name. Did he avoid incriminating evidence — or is it just rumor mill chatter?

Binance vs FTX: $1.76B Legal Battle. Binance has asked the court to dismiss a lawsuit from FTX, which seeks to reclaim $1.76 billion. Even post-collapse, the battle over who owes what continues.

DOJ Investigates Coinbase Data Breach. The U.S. Department of Justice has launched an investigation into unauthorized access of Coinbase customer data. No word yet on how many were affected — but this one’s officially criminal.

Upcoming major token unlocks:

SUI: $157.50M (1.3%)

BIO: $28.74M (19.8%)

OP: $23.92M (1.8%)

KMNO: $15.48M (14.8%)

ZETA: $11.29M (5.3%)

REZ: $5.86M (16.0%)

SimpleSwap reminds you that this article is provided for informational purposes only and does not provide investment advice. All purchases and cryptocurrency investments are your own responsibility.