Weekly Crypto Market Wrap June 2-8, 2025

Last week saw relatively quiet price action — Bitcoin edged up just 0.5%, which feels like a win considering it briefly dipped below $101K mid-week. But while BTC flirted with support levels, crypto Twitter turned into a soap opera: the Trump–Musk “bromance” broke up in full public view. Still, knowing these two, it could just be another act in the ongoing “let’s shake the markets” show. Let’s break down what really happened this week:

Circle Raises $1.1B in IPO. Stablecoins? Boring? Not quite. Circle, the issuer of USDC, successfully raised $1.1 billion through its IPO. In the middle of a bearish backdrop, that’s a strong signal. Clearly, Circle isn’t content being second to Tether — they’re thinking much bigger.

Eric Trump Says WLFI Plans to Buy TRUMP Tokens. Following in his father’s crypto footsteps, Eric Trump revealed that investment firm WLFI — where he holds influence — plans to accumulate TRUMP tokens. Whether this is a show of blockchain conviction or just a family business move, one thing’s clear: it’s pumping the hype.

Source: https://x.com/EricTrump/status/1931075264936550480

Apple, X, Airbnb Exploring Stablecoin Integrations. A dream inching closer to reality — Apple, X (Twitter), Airbnb, and Google Cloud are reportedly looking into integrating stablecoins. Imagine paying for a vacation or iPhone with USDC — the shift to mainstream adoption is picking up pace.

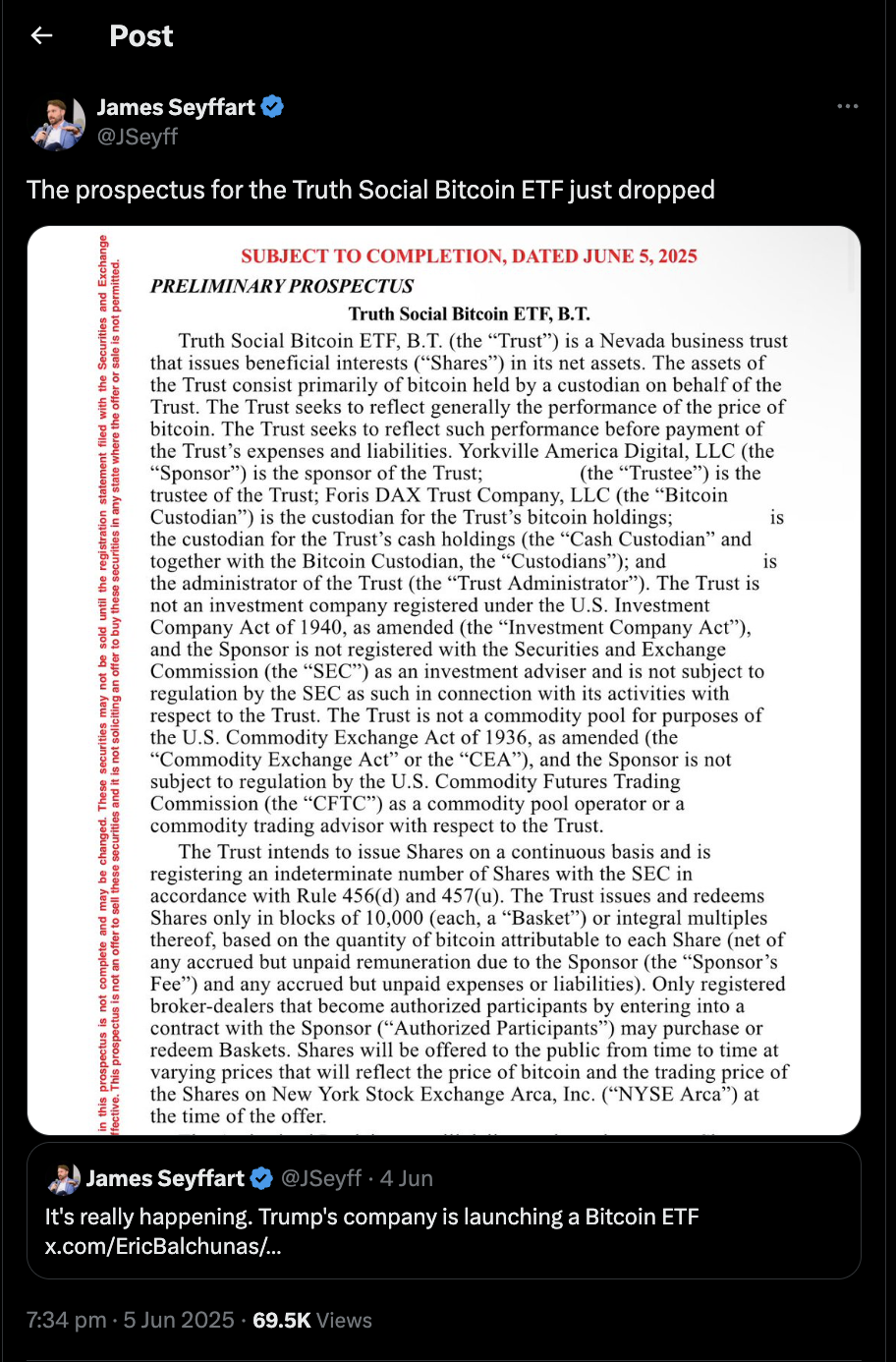

Truth Social Files for Bitcoin ETF with SEC. In a bold move, Trump’s Truth Social filed an application to launch a Bitcoin ETF. It seems "financial freedom" is going full blockchain — straight from the podium to the protocol.

Source: https://x.com/JSeyff/status/1930604050648608819

Trump Media Eyes $12B Raise – Eyes BTC Allocation. Trump Media, parent of Truth Social, plans to raise a whopping $12 billion through a stock offering — with part of that reportedly earmarked for Bitcoin. From “Make America Great Again” to “Stack Sats Greatly.”

Strategy Adds “Only” 705 BTC ($75M). It was a modest week for Strategy, who added “just” 705 BTC to their reserves — bringing their total to 580,955 BTC. But Metaplanet stole the spotlight, scooping up 1,088 BTC for $117M. Is this the rise of a new mini–Michael Saylor?

Gemini Files Confidential IPO Paperwork. The Winklevoss twins are back in the IPO arena — this time with Gemini. The exchange has filed for a public listing, signaling a renewed race for institutional capital.

Robinhood Acquires Bitstamp for $200M. Robinhood is strengthening its crypto stack by acquiring Bitstamp, one of the oldest European exchanges, for $200 million. Could this be the long-awaited bridge between UX-friendly apps and serious global liquidity?

U.S. Extends Tariff Pause on Chinese Goods Until August 31. Call it consolidation before a breakout — the U.S. has extended its tariff pause on Chinese imports. But only until August 31. Breathe easy — for now.

Source: https://x.com/DeItaone/status/1929631335272141105

Trump Hikes Steel and Aluminum Tariffs to 50%. Trump’s going full old-school protectionism: 50% tariffs on steel and aluminum imports are back. The trade war narrative resurfaces — and with it, inflation worries.

ECB Cuts Interest Rates by 25bps. The European Central Bank delivered a 25 basis point rate cut, giving markets a breather. It’s the first of what may be a series of steps to revive economic momentum across the bloc.

U.S. Unemployment Holds Steady at 4.2%. No surprises here: the U.S. unemployment rate remains unchanged at 4.2%. A stable labor market means the Fed has no immediate pressure to change course.

Upcoming major token unlocks:

CONX: $129.69M (315.0%)

CHEEL: $108.43M

APT: $53.95M (1.8%)

STRK: $17.03M (3.8%)

IMX: $12.87M (1.3%)

SEI: $10.60M (1.0%)

SimpleSwap reminds you that this article is provided for informational purposes only and does not provide investment advice. All purchases and cryptocurrency investments are your own responsibility.